In other words, its accounts receivables are better protected as service can be disconnected before further credit is extended to the customer. All customers are billed a month in advance of service delivery, thereby preventing any customer from receiving services without paying the bill.

#Industry inventory turnover ratio tv

A few may go out of business and not pay Joe’s Bait Company anything at all, which would result in bad debt.īy comparison, LookeeLou Cable TV company delivers cable TV, internet and VoIP phone service to consumers. Some of the company’s customers pay on time as agreed, but some pay late. Payment terms are the same for each customer: net30, meaning payment is due thirty days after the invoice date. The company invoices each of the stores once a month. The accounts receivable turnover ratio, or receivables turnover, is used in business accounting to quantify how well companies are managing the credit that they extend to their customers by evaluating how long it takes to collect the outstanding debt throughout the accounting period.įor example, Joe’s Bait Company supplies fish bait to stores at docks and marinas throughout the Southeast. What Is Accounts Receivable (AR) Turnover Ratio? If money is not coming in from customers as agreed and expected, cash flow can dry to a trickle.Ĭonversely, when collections are managed efficiently, a business’s cash flow becomes more predictable, collection costs are lower and its balance sheet is healthier, which is a very important factor when a company seeks to obtain credit, invest in growth and attract investors. The accounts receivable turnover ratio is one metric to watch closely as it measures how effectively a company is handling collections.

#Industry inventory turnover ratio how to

In the next section, you have examples of how to calculate inventory turnover ratios using Google Sheets.East, Nordics and Other Regions (opens in new tab) In fact, using Excel or Google Sheets together with Layer, you can automate inventory management and control: from initial data collection and synchronization from multiple users to automatically sharing the final reports. Fortunately, tools like Excel and Google Sheets let you create templates to standardize and automate these calculations.

In other words, this is not something you should attempt to do manually. By analyzing the data, you can investigate any unexpected values and uncover potential inventory problems. However, you need to recalculate this periodically to make real use of this information.

It provides insight into how well a company sells its products and manages its inventory. Use the following formula to calculate the number of days it takes to use up the inventory: average days to sell inventory = 365 / inventory turnover ratio How to Calculate Inventory Turnover in Excel or Google Sheets?Īs you can see, inventory turnover is a useful financial ratio. You can also quickly convert this to obtain the number of days a turn takes.

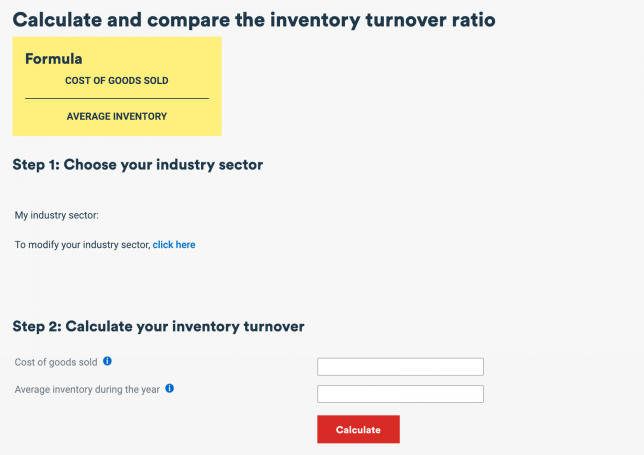

Where average inventory = (beginning inventory - end inventory) / 2 inventory turnover ratio = COGS / average inventory You can use the following formula to calculate inventory turns for a given period of time. You can use whatever timeframe you prefer, but it’s common to use yearly, quarterly, or monthly data. The average inventory can be calculated by adding the beginning and end inventories for the period and dividing by 2. To calculate the inventory turnover ratio, divide the cost of goods sold (COGS) for a given period by the average inventory for that same period. For example, the finance and service sectors have the highest averages for inventory turnover. If you work with intangibles, inventory turnover can be exceptionally high. However, the values themselves change drastically depending on various factors. Generally speaking, higher values are preferred by all interested parties. However, what “high” and “low” means will vary significantly by industry and business model. A low ratio can indicate low sales or overstocking. However, too high a value could indicate a higher likelihood of stock shortages. What is a Good Inventory Turnover Ratio?Ī high ratio indicates that your products sell well since inventory is used quickly. Values calculated using net sales can be significantly and misleadingly higher. When comparing ratio values, remember to check whether they were calculated using the same method. However, the latter is usually preferred, as using the value for COGS provides a more accurate result. There are different methods available to find the inventory turnover ratio, using net sales or cost of goods sold (COGS). This value can also be recalculated so that it is expressed in days. The inventory turnover ratio indicates how many times inventory was replenished during a specific timeframe.

Inventory turnover shows how quickly a company uses its inventory.

0 kommentar(er)

0 kommentar(er)